(能动Nengdong2023年6月2日讯)TrueCar公司是购买和销售新旧车辆最简便、高效和透明的在线平台,该平台预计到2023年5月,新车销售总量将达到1,388,602台,比去年同期增长近20%,比2023年4月增长6.5%。除去大宗销售,TrueCar预计美国新车和轻型卡车的零售交付量将达到1,145,561台,比去年同期增长近16%,比2023年4月增长7%。

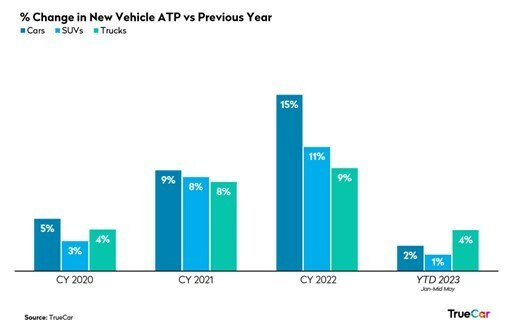

% Change in New Vehicle ATP vs Previous Year

“随着夏季的到来,销售预计将强劲,不断增长的激励措施和库存选项将吸引消费者回到市场,”TrueCar的行业分析师Zack Krelle表示。

“今年卡车的平均交易价格上涨最多,因为SUV和轿车的激励措施增长更快。SUV的激励措施增长最快,这极大地促进了高销售速度,”TrueCar的OEM解决方案副总裁Justin Colon表示。

其他5月份行业洞察(来自TrueCar):

·2023年5月的总销售额预计将比去年同期增长近20%,根据相同的销售天数进行调整后,将比2023年4月增长6.5%。

·预计2023年5月的大宗销量将比去年同期增长近40%,根据相同的销售天数进行调整后,将比2023年4月增长4%。

·新车的平均交易价格预计将比去年同期上涨2.7%,与2023年4月的价格持平。

·预计2023年5月的二手车销量将达到310万辆左右,比去年同期下降4%,比2023年4月增长1%。

·新车平均利率为7.1%,略高于2023年4月,二手车平均利率为10.75%,与2023年4月基本持平。

·到2023年5月,新车的平均贷款期限约为69个月,二手车的平均贷款期限约为70个月。

|

Total Unit Sales |

|||||||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

YoY % Change |

YoY % Change |

MoM % Change |

MoM % Change |

|

BMW |

31,087 |

26,988 |

29,925 |

15.2 % |

10.6 % |

3.9 % |

8.0 % |

|

Daimler |

31,451 |

24,851 |

29,786 |

26.6 % |

21.5 % |

5.6 % |

9.8 % |

|

Ford |

179,977 |

153,434 |

182,623 |

17.3 % |

12.6 % |

-1.4 % |

2.5 % |

|

GM |

234,596 |

177,856 |

227,329 |

31.9 % |

26.6 % |

3.2 % |

7.3 % |

|

Honda |

124,393 |

75,491 |

116,082 |

64.8 % |

58.2 % |

7.2 % |

11.4 % |

|

Hyundai |

75,752 |

63,832 |

76,669 |

18.7 % |

13.9 % |

-1.2 % |

2.8 % |

|

Kia |

67,125 |

57,941 |

68,205 |

15.9 % |

11.2 % |

-1.6 % |

2.4 % |

|

Nissan |

84,290 |

53,381 |

83,746 |

57.9 % |

51.6 % |

0.6 % |

4.7 % |

|

Stellantis |

148,938 |

130,987 |

137,019 |

13.7 % |

9.2 % |

8.7 % |

13.0 % |

|

Subaru |

52,554 |

42,526 |

51,014 |

23.6 % |

18.6 % |

3.0 % |

7.1 % |

|

Tesla |

56,835 |

47,706 |

55,865 |

19.1 % |

14.4 % |

1.7 % |

5.8 % |

|

Toyota |

186,666 |

176,772 |

185,988 |

5.6 % |

1.4 % |

0.4 % |

4.4 % |

|

Volkswagen Group |

51,858 |

46,397 |

50,591 |

11.8 % |

7.3 % |

2.5 % |

6.6 % |

|

Industry |

1,388,602 |

1,114,583 |

1,356,551 |

24.6 % |

19.6 % |

2.4 % |

6.5 % |

|

Retail Unit Sales |

|||||||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

YoY % Change |

YoY % Change |

MoM % Change |

MoM % Change |

|

BMW |

28,336 |

25,915 |

28,202 |

9.3 % |

5.0 % |

0.5 % |

4.5 % |

|

Daimler |

29,606 |

23,309 |

28,351 |

27.0 % |

21.9 % |

4.4 % |

8.6 % |

|

Ford |

128,491 |

113,103 |

126,733 |

13.6 % |

9.1 % |

1.4 % |

5.4 % |

|

GM |

179,999 |

139,026 |

172,383 |

29.5 % |

24.3 % |

4.4 % |

8.6 % |

|

Honda |

120,654 |

71,143 |

113,789 |

69.6 % |

62.8 % |

6.0 % |

10.3 % |

|

Hyundai |

69,766 |

63,188 |

70,997 |

10.4 % |

6.0 % |

-1.7 % |

2.2 % |

|

Kia |

60,484 |

54,484 |

60,677 |

11.0 % |

6.6 % |

-0.3 % |

3.7 % |

|

Nissan |

61,525 |

43,630 |

61,095 |

41.0 % |

35.4 % |

0.7 % |

4.7 % |

|

Stellantis |

102,296 |

103,631 |

89,742 |

-1.3 % |

-5.2 % |

14.0 % |

18.5 % |

|

Subaru |

49,452 |

41,185 |

48,367 |

20.1 % |

15.3 % |

2.2 % |

6.3 % |

|

Tesla |

54,634 |

36,909 |

54,818 |

48.0 % |

42.1 % |

-0.3 % |

3.6 % |

|

Toyota |

162,131 |

155,658 |

162,369 |

4.2 % |

0.0 % |

-0.1 % |

3.8 % |

|

Volkswagen Group |

47,670 |

44,836 |

46,974 |

6.3 % |

2.1 % |

1.5 % |

5.5 % |

|

Industry |

1,145,561 |

949,271 |

1,113,487 |

20.7 % |

15.9 % |

2.9 % |

7.0 % |

|

Fleet Unit Sales |

|||||||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

YoY % Change |

YoY % Change |

MoM % Change |

MoM % Change |

|

BMW |

2,751 |

1,073 |

1,723 |

156.3 % |

146.0 % |

59.7 % |

66.1 % |

|

Daimler |

1,845 |

1,542 |

1,435 |

19.6 % |

14.8 % |

28.6 % |

33.7 % |

|

Ford |

51,486 |

40,331 |

55,890 |

27.7 % |

22.6 % |

-7.9 % |

-4.2 % |

|

GM |

54,597 |

38,830 |

54,946 |

40.6 % |

35.0 % |

-0.6 % |

3.3 % |

|

Honda |

3,739 |

4,348 |

2,293 |

-14.0 % |

-17.4 % |

63.1 % |

69.6 % |

|

Hyundai |

5,986 |

644 |

5,672 |

829.7 % |

792.5 % |

5.5 % |

9.8 % |

|

Kia |

6,641 |

3,457 |

7,528 |

92.1 % |

84.4 % |

-11.8 % |

-8.2 % |

|

Nissan |

22,765 |

9,751 |

22,651 |

133.5 % |

124.1 % |

0.5 % |

4.5 % |

|

Stellantis |

46,642 |

27,356 |

47,277 |

70.5 % |

63.7 % |

-1.3 % |

2.6 % |

|

Subaru |

3,102 |

1,341 |

2,647 |

131.4 % |

122.1 % |

17.2 % |

21.9 % |

|

Tesla |

2,201 |

10,797 |

1,047 |

-79.6 % |

-80.4 % |

110.3 % |

118.7 % |

|

Toyota |

24,535 |

21,114 |

23,619 |

16.2 % |

11.6 % |

3.9 % |

8.0 % |

|

Volkswagen Group |

4,188 |

1,561 |

3,617 |

168.2 % |

157.5 % |

15.8 % |

20.4 % |

|

Industry |

239,075 |

165,114 |

239,522 |

44.8 % |

39.0 % |

-0.2 % |

3.8 % |

|

Fleet Penetration |

|||||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

YoY % Change |

MoM % Change |

|

BMW |

8.8 % |

4.0 % |

5.8 % |

122.5 % |

53.7 % |

|

Daimler |

5.9 % |

6.2 % |

4.8 % |

-5.5 % |

21.8 % |

|

Ford |

28.6 % |

26.3 % |

30.6 % |

8.8 % |

-6.5 % |

|

GM |

23.3 % |

21.8 % |

24.2 % |

6.6 % |

-3.7 % |

|

Honda |

3.0 % |

5.8 % |

2.0 % |

-47.8 % |

52.2 % |

|

Hyundai |

7.9 % |

1.0 % |

7.4 % |

683.4 % |

6.8 % |

|

Kia |

9.9 % |

6.0 % |

11.0 % |

65.8 % |

-10.4 % |

|

Nissan |

27.0 % |

18.3 % |

27.0 % |

47.9 % |

-0.1 % |

|

Stellantis |

31.3 % |

20.9 % |

34.5 % |

50.0 % |

-9.2 % |

|

Subaru |

5.9 % |

3.2 % |

5.2 % |

87.2 % |

13.7 % |

|

Tesla |

3.9 % |

22.6 % |

1.9 % |

-82.9 % |

106.7 % |

|

Toyota |

13.1 % |

11.9 % |

12.7 % |

10.0 % |

3.5 % |

|

Volkswagen Group |

8.1 % |

3.4 % |

7.2 % |

140.0 % |

12.9 % |

|

Industry |

17.2 % |

14.8 % |

17.7 % |

16.2 % |

-2.5 % |

|

Total Market Share |

|||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

|

BMW |

2.2 % |

2.4 % |

2.2 % |

|

Daimler |

2.3 % |

2.2 % |

2.2 % |

|

Ford |

13.0 % |

13.8 % |

13.5 % |

|

GM |

16.9 % |

16.0 % |

16.8 % |

|

Honda |

9.0 % |

6.8 % |

8.6 % |

|

Hyundai |

5.5 % |

5.7 % |

5.7 % |

|

Kia |

4.8 % |

5.2 % |

5.0 % |

|

Nissan |

6.1 % |

4.8 % |

6.2 % |

|

Stellantis |

10.7 % |

11.8 % |

10.1 % |

|

Subaru |

3.8 % |

3.8 % |

3.8 % |

|

Tesla |

4.1 % |

4.3 % |

4.1 % |

|

Toyota |

13.4 % |

15.9 % |

13.7 % |

|

Volkswagen Group |

3.7 % |

4.2 % |

3.7 % |

|

95.5 % |

96.7 % |

95.5 % |

|

|

Retail Market Share |

|||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

|

BMW |

2.5 % |

2.7 % |

2.5 % |

|

Daimler |

2.6 % |

2.5 % |

2.5 % |

|

Ford |

11.2 % |

11.9 % |

11.4 % |

|

GM |

15.7 % |

14.6 % |

15.5 % |

|

Honda |

10.5 % |

7.5 % |

10.2 % |

|

Hyundai |

6.1 % |

6.7 % |

6.4 % |

|

Kia |

5.3 % |

5.7 % |

5.4 % |

|

Nissan |

5.4 % |

4.6 % |

5.5 % |

|

Stellantis |

8.9 % |

10.9 % |

8.1 % |

|

Subaru |

4.3 % |

4.3 % |

4.3 % |

|

Tesla |

4.8 % |

3.9 % |

4.9 % |

|

Toyota |

14.2 % |

16.4 % |

14.6 % |

|

Volkswagen Group |

4.2 % |

4.7 % |

4.2 % |

|

95.6 % |

96.5 % |

95.6 % |

|

|

ATP |

|||||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

YOY |

MOM |

|

BMW |

$70,162 |

$64,688 |

$69,289 |

8.5 % |

1.3 % |

|

Daimler |

$74,718 |

$64,698 |

$78,504 |

15.5 % |

-4.8 % |

|

Ford |

$54,122 |

$50,878 |

$54,073 |

6.4 % |

0.1 % |

|

GM |

$53,039 |

$50,582 |

$52,280 |

4.9 % |

1.5 % |

|

Honda |

$37,793 |

$38,045 |

$37,801 |

-0.7 % |

0.0 % |

|

Hyundai |

$37,399 |

$37,208 |

$37,540 |

0.5 % |

-0.4 % |

|

Kia |

$35,064 |

$35,043 |

$34,232 |

0.1 % |

2.4 % |

|

Nissan |

$36,729 |

$36,349 |

$36,506 |

1.0 % |

0.6 % |

|

Stellantis |

$56,207 |

$53,425 |

$55,951 |

5.2 % |

0.5 % |

|

Subaru |

$34,328 |

$35,455 |

$34,803 |

-3.2 % |

-1.4 % |

|

Toyota |

$42,834 |

$39,335 |

$42,885 |

8.9 % |

-0.1 % |

|

Volkswagen Group |

$47,126 |

$47,571 |

$47,424 |

-0.9 % |

-0.6 % |

|

Industry |

$45,779 |

$44,565 |

$45,486 |

2.7 % |

0.6 % |

|

$1,213 |

$293 |

||||

|

Incentives |

|||||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

YOY |

MOM |

|

BMW |

$3,937 |

$1,182 |

$3,636 |

233.1 % |

8.3 % |

|

Daimler |

$3,014 |

$1,253 |

$2,992 |

140.5 % |

0.7 % |

|

Ford |

$2,270 |

$1,037 |

$1,800 |

119.0 % |

26.1 % |

|

GM |

$2,255 |

$1,725 |

$1,959 |

30.7 % |

15.1 % |

|

Honda |

$1,373 |

$790 |

$1,192 |

73.7 % |

15.1 % |

|

Hyundai |

$1,597 |

$551 |

$1,427 |

190.1 % |

11.9 % |

|

Kia |

$1,116 |

$656 |

$958 |

70.1 % |

16.5 % |

|

Nissan |

$1,787 |

$1,580 |

$1,895 |

13.1 % |

-5.7 % |

|

Stellantis |

$3,359 |

$1,894 |

$2,848 |

77.4 % |

17.9 % |

|

Subaru |

$1,090 |

$756 |

$939 |

44.1 % |

16.0 % |

|

Toyota |

$832 |

$787 |

$808 |

5.8 % |

3.0 % |

|

Volkswagen Group |

$2,827 |

$1,137 |

$2,600 |

148.5 % |

8.7 % |

|

Industry |

$1,931 |

$1,176 |

$1,704 |

64.3 % |

13.3 % |

|

$756 |

$227 |

||||

|

Incentives as % of ATP |

|||||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

YOY |

MOM |

|

BMW |

5.6 % |

1.8 % |

5.2 % |

207.1 % |

6.9 % |

|

Daimler |

4.0 % |

1.9 % |

3.8 % |

108.3 % |

5.8 % |

|

Ford |

4.2 % |

2.0 % |

3.3 % |

105.8 % |

26.0 % |

|

GM |

4.3 % |

3.4 % |

3.7 % |

24.7 % |

13.5 % |

|

Honda |

3.6 % |

2.1 % |

3.2 % |

74.9 % |

15.2 % |

|

Hyundai |

4.3 % |

1.5 % |

3.8 % |

188.6 % |

12.3 % |

|

Kia |

3.2 % |

1.9 % |

2.8 % |

70.0 % |

13.7 % |

|

Nissan |

4.9 % |

4.3 % |

5.2 % |

11.9 % |

-6.3 % |

|

Stellantis |

6.0 % |

3.5 % |

5.1 % |

68.6 % |

17.4 % |

|

Subaru |

3.2 % |

2.1 % |

2.7 % |

48.8 % |

17.6 % |

|

Toyota |

1.9 % |

2.0 % |

1.9 % |

-2.9 % |

3.1 % |

|

Volkswagen Group |

6.0 % |

2.4 % |

5.5 % |

150.9 % |

9.4 % |

|

Industry |

4.2 % |

2.6 % |

3.7 % |

59.9 % |

12.6 % |

|

Revenue |

|||||

|

Manufacturer |

May 2023 Forecast |

May 2022 Actual |

Apr 2023 Actual |

YOY |

MOM |

|

Industry |

$63,568,387,218 |

$49,671,624,150 |

$61,703,570,423 |

28.0 % |

3.0 % |

(备注:这份行业洞察仅基于TrueCar,Inc.对国内行业销售趋势和条件的分析,不是TrueCar,Inc.运营的预测。)

0 条评论